Finance Systems

Drive financial data exchange to ensure accurate accounts and generate insightful reports.

Little things add up

A constant challenge faced by every business is keeping financial ledgers accurate and up-to-date. And for hospitality, the burden is great. Invoices are low in value, high in number, come from diverse suppliers, and often require manual keying. Meanwhile, high staff numbers, with regular turnover and constant shift reshuffling, makes for a demanding payroll process. Each additional burden on top of these means accounts are time-consuming and error prone, leading to incorrect payments and late management reporting.

Streamlining these processes is possible. The Fourth platform manages the processing of all purchases, and all aspects of workforce planning and costs, and therefore holds a vast array of data that is relevant to finance.

By integrating your finance system with Fourth, you can ensure that reliable and accurate information is efficiently exchanged, reviewed as needed, posted to the finance ledger, and made available for reports; all without manual re-entry or data. Further more, integrations with Fourth:

- Are tailored to the needs and technology of the finance system, and only transfers required data.

- Are built on modern and secure technologies.

- Use robust technical systems and processes, including automated timed data transfers, self-checking and auditing, and error management that sends alerts to named recipients.

- Provide the finance team with clear and open information about each data transfer, and allow the team to easily perform manual overrides, rerun transfers, and enable or disable transfers.

- Benefit from clear, well-documented support processes.

How does it work?

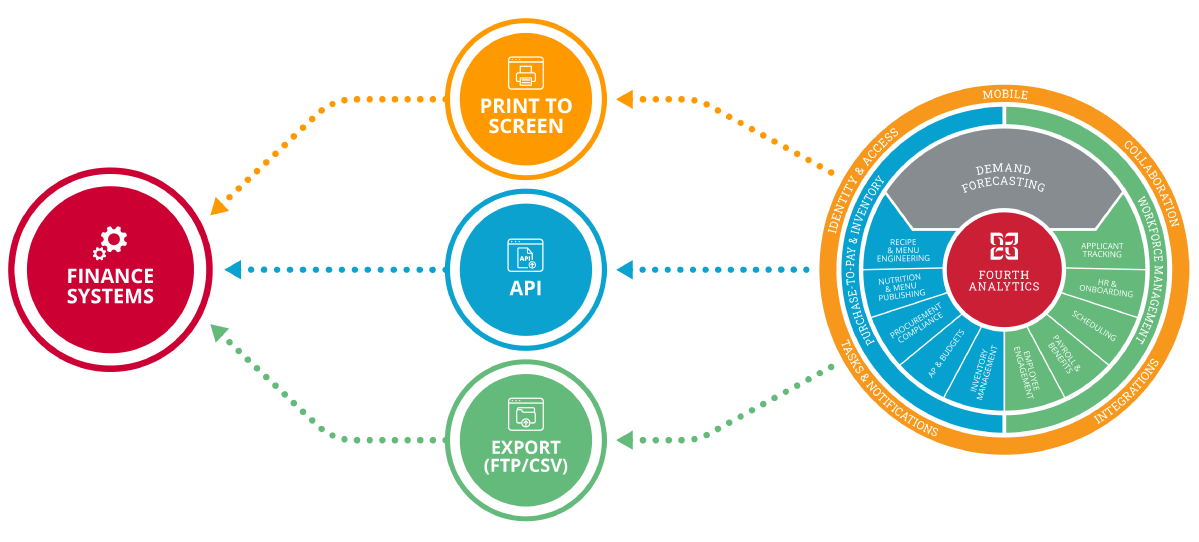

Fourth can export data from our solutions in a number of ways:

Integration

In discussion with your business, we identify the best integration option to use. For many customers, the finance team drives exports between the two systems as they require, using CSV files. However, Fourth has a flexible integration policy and a dedicated team experienced in many different solutions, databases, data formats, and protocols.

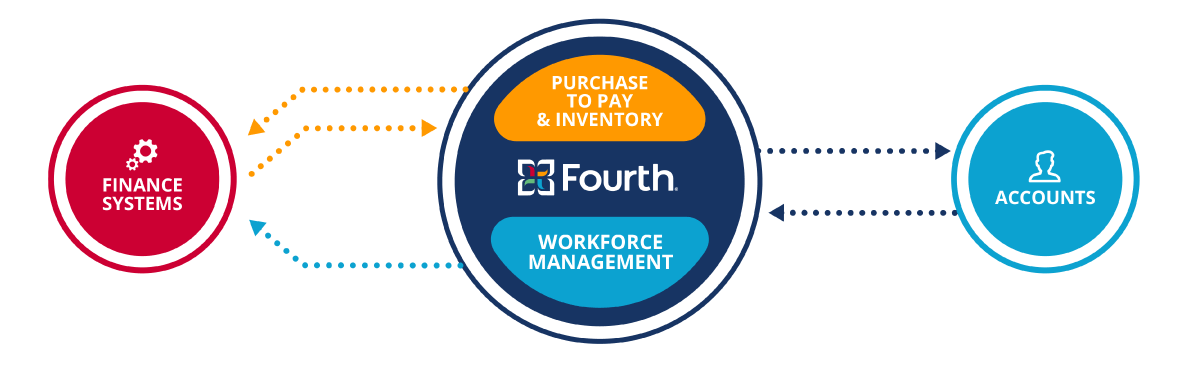

Once integrated, customers can export relevant financial data from our Purchase to Pay & Inventory and Workforce Management solutions to the finance system.

Workforce Management

Fourth provides hundreds of workforce management exports to match the requirements of finance systems. These exports can be both on-demand or scheduled as desired. They can deliver all data around wages and salaries, and provide detailed postings by location, such as:

- The costs of wages, salaries, and employer’s National Insurance, assigned to profit and loss (P&L) finance codes.

- Deductions from pay to balance sheet accounts for eventual pay overs. For example: tax, National Insurance, court orders, or student loans.

Purchase to Pay & Inventory

Fourth Purchase to Pay & Inventory has a wide variety of exports that can be both on-demand or scheduled, and include data such as:

- Invoices approved for payment posted to nominal codes and supplier accounts ready for payment.

- Accruals for goods received but not invoiced.

- Accruals for credits requested but not yet received from suppliers.

Insights delivered through Analytics

Business insights from Fourth Analytics complements the reports driven from your finance system. Fourth Analytics can store high level metrics — such as fixed and variable costs — and combine these with sales and non-financial data from the Fourth platform. This produces meaningful and insightful analysis for customers, such as:

- Efficiency insights; for example, the number of orders that are 100% filled, or the amount of credits processed by site.

- Area and brand summaries, with the ability to drill down to identify issues and create improvement plans.

- Sales and labor optimization, by linking sales data from POS systems to workforce planning data.

Workflow

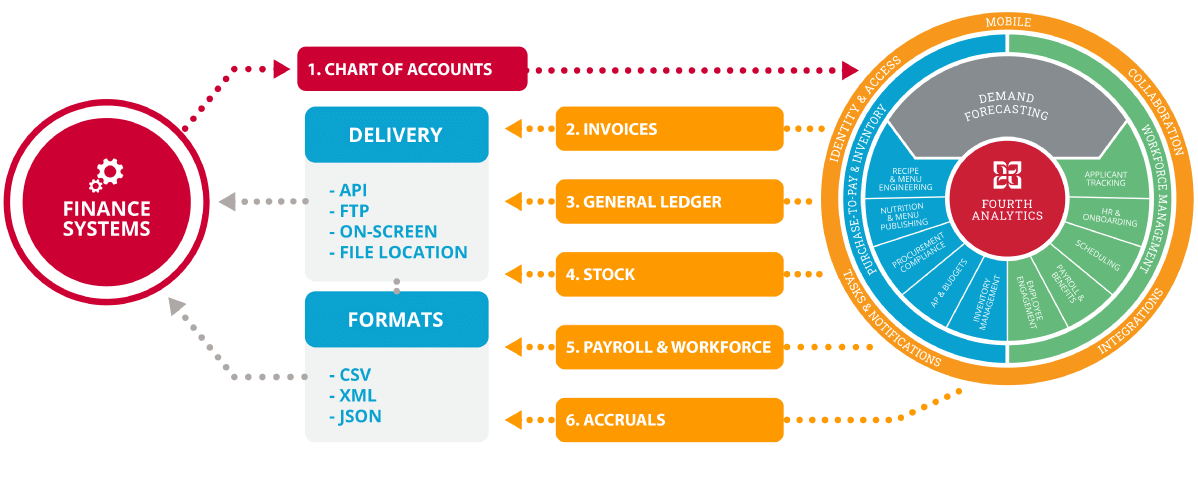

An example — but not at all mandatory — workflow between Fourth and a finance system is as follows:

- During the initial integration process, a chart of accounts is exported from the finance system. The Fourth team configures a mapping from this to the customer's Fourth setup. This is normally only required for Fourth Adaco integrations.

- Once a day, the customer processes invoices and credits in Fourth. These are then imported by the finance system.

- Once a week, a general ledger export (also called the purchase ledger or stock ledger) is exported from Fourth and imported by the finance system.

- Once a week, a stock export is generated in Fourth and imported by the finance system.

- Once every payroll period, payroll and other workforce data exports are generated in Fourth and imported by the finance system.

- At the end of each finance period, an accrual export is generated in Fourth and imported by the finance system.

Integrations

As we customize integrations to your capabilities and needs, the best next step is to get in contact with our team for an initial chat. Typical integrations use CSV exports, but can include the following:

- Enterprise resource planning (ERP) platforms, such as Workday, Salesforce, Dynamics and SAP.

- Other file formats such as XML and JSON.

- Public APIs, using protocols such as REST and SOAP.

- Data in public clouds, such as Amazon, Azure and Google.

- Database formats, such as SQL, DB2, Hadoop and Oracle.

Next steps

If you have an existing mutual customer who has asked for a Fourth integration, please work with the Fourth Professional Services team member assigned to the customer and project. They can advise you as to which APIs best suit your business and customer requirements. Your mutual customer can provide their contact details.

If we do not yet have a mutual customer, please contact the Fourth Partnerships Team to find out more about partnering and on-boarding.